Maximising Your Age Pension While Paying for Aged Care

Navigating the financial complexities of aged care can be a daunting task, but it is a crucial aspect of ensuring a comfortable and secure retirement. As the population ages, understanding how to maximise your age pension while managing the costs associated with aged care becomes increasingly important. The age pension serves as a cornerstone for many retirees, providing essential financial support. This blog post delves into strategies to optimise your age pension benefits while effectively covering aged care expenses.

Understanding the Age Pension

Eligibility for the age pension hinges on several criteria, including age, residency, and income and asset tests. To qualify, you must be of pensionable age, an Australian resident, and meet specific income and asset thresholds. The age pension is calculated based on these assessments, with payments adjusted accordingly to ensure fair distribution of government support.

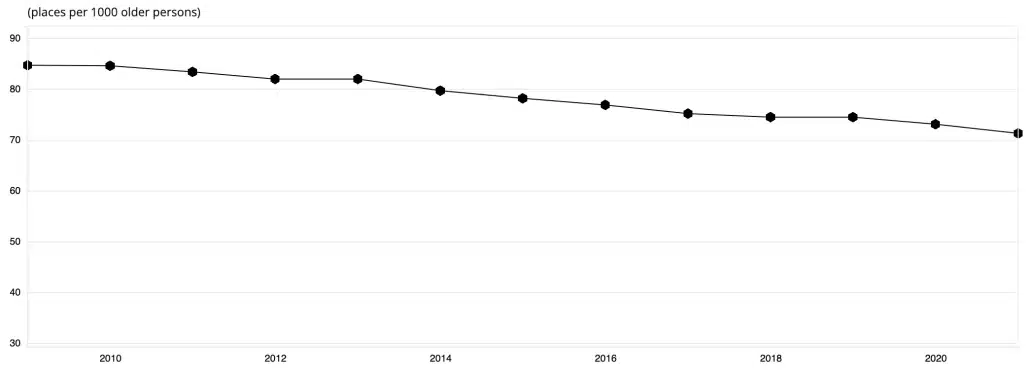

Navigating Aged Care Costs

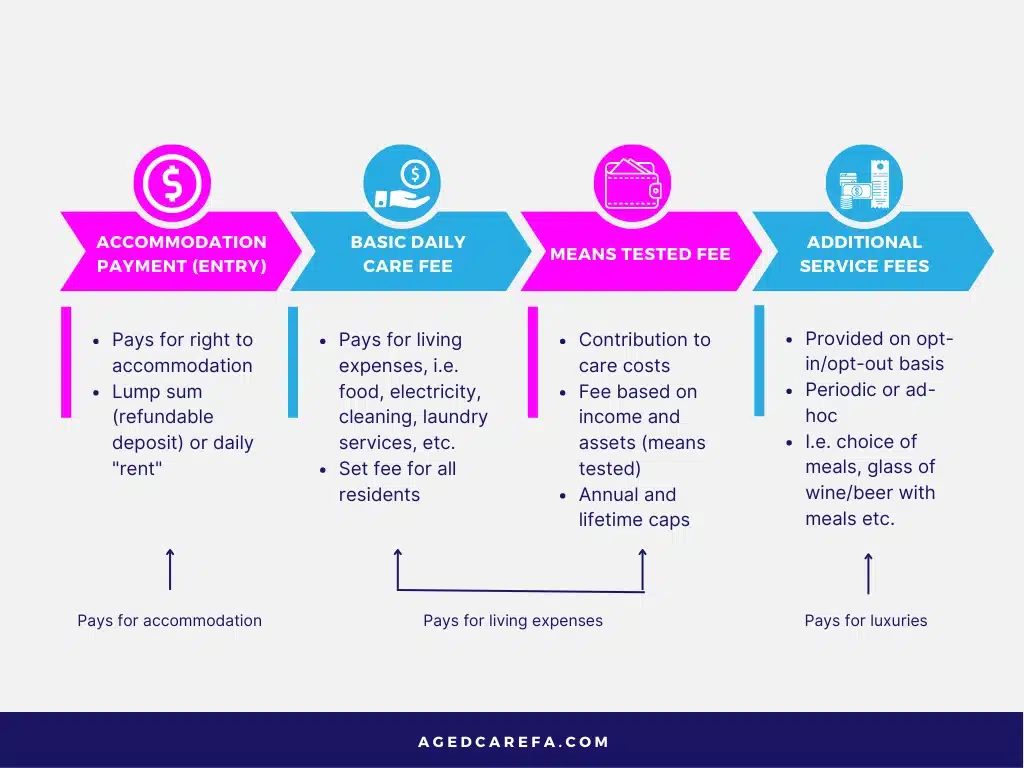

Aged care services encompass a broad spectrum, from in-home assistance to residential care. Each type of service comes with its own set of costs, often leaving individuals overwhelmed. Fortunately, the government provides subsidies and financial support to alleviate some of these burdens. Understanding the various types of aged care and their associated costs is the first step in effective financial planning.

Asset and Income Assessment

Your assets and income significantly impact your eligibility for the age pension. Assets such as property, investments, and savings, along with income from various sources, are meticulously assessed. To maximise your pension, it is essential to explore strategies that minimise assessable assets and income, thereby optimising your entitlements. This can involve restructuring investments, utilising superannuation, and careful financial planning.

Utilising Home Equity

For many, the family home represents a substantial portion of their wealth. Utilising this equity can be a viable option for funding aged care. Reverse mortgages, for example, allow you to access the equity in your home without needing to sell it. This can provide a steady stream of income to cover aged care costs while maintaining your pension eligibility.

Financial Products for Aged Care

Certain financial products are tailored to meet the needs of those planning for aged care. Annuities, for instance, can provide a guaranteed income stream, offering financial stability. Investment bonds are another strategic tool, allowing you to invest in a tax-efficient manner while potentially reducing assessable assets. Understanding these products and their benefits is key to informed financial planning.

Gifting and Financial Transfers

Gifting assets or transferring money to family members can impact your age pension. The government imposes strict rules on such activities to prevent manipulation of pension eligibility. However, with careful planning, it is possible to make effective financial transfers without adversely affecting your pension. This requires a thorough understanding of the rules and strategic timing of gifts.

Professional Financial Advice

The complexities of maximising your age pension while paying for aged care often necessitate professional guidance. A qualified financial adviser can provide invaluable assistance, helping you navigate the myriad of options and regulations. Choosing the right adviser, one with expertise in aged care financial planning, can make a significant difference in your financial well-being. Get in contact with us 1300 550 940 and we help people all over Australia with aged care financial advice online.

Conclusion

Balancing the need to maximise your age pension while managing aged care costs is a delicate but achievable goal. By understanding the intricacies of the age pension, exploring financial products, utilising home equity, and seeking professional advice, you can create a robust financial plan. This ensures that you or your loved ones can enjoy a secure and comfortable retirement, free from financial stress.