Importance of the MPIR for low means and high means residents

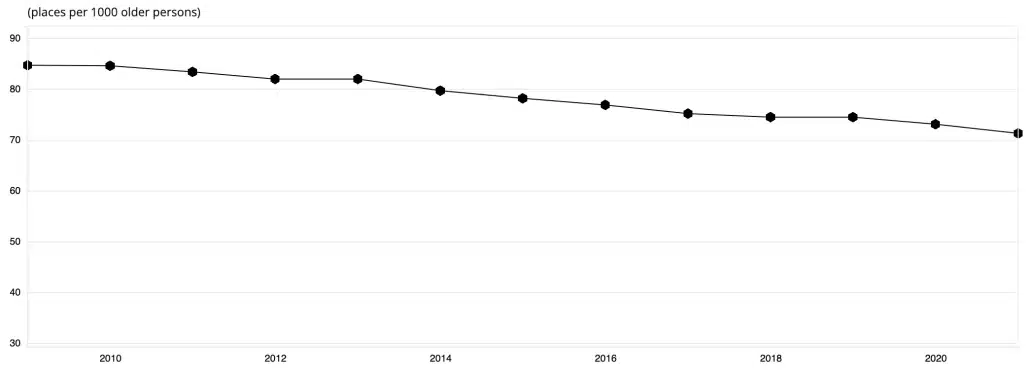

In Australia, the maximum permissible interest rate (MPIR) plays a significant role in determining the cost of aged care accommodation for residents. The MPIR is a government-set interest rate that is reviewed quarterly. It has seen a substantial increase, rising from 4.07% in April 2022 to 8.34% as of April 2024. Understanding how the MPIR impacts accommodation costs is crucial for both low-means and high-means residents planning for aged care.

In this blog post, we’ll dive into the role of the MPIR (Maximum Permissible Interest Rate) in determining how much residents pay for their aged care accommodation. We’ll explore how the MPIR affects both low-means residents and those who contribute an accommodation payment (high means residents). We’ll also use clear examples to illustrate how changes in the MPIR can impact daily accommodation costs

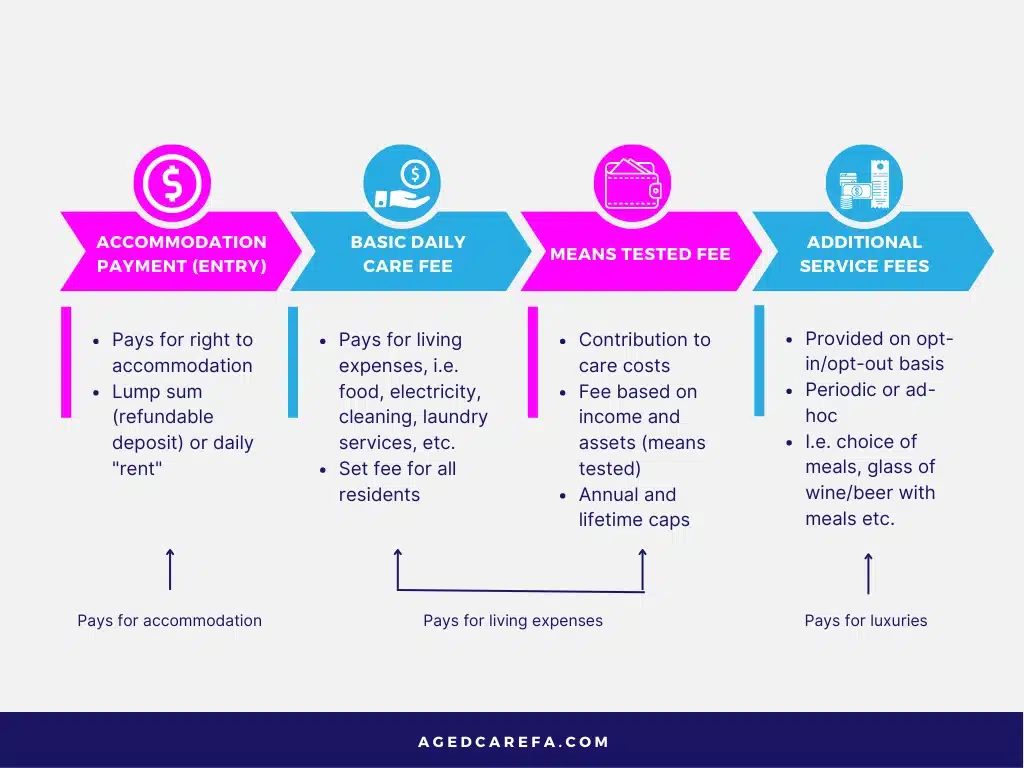

Accommodation payment options

Upon entering residential aged care, residents are classified as either “low means” or “accommodation payment” based on an assessment of their assets and income. This assessment compares a resident’s means-tested amount to a government benchmark called the Maximum Accommodation Supplement (MAS). Currently, the MAS sits at $68.14 per day, representing the maximum daily support the government provides for low means residents’ accommodation costs.

For low means residents, there are three flexible ways to pay for their accommodation:

- Refundable Accommodation Contribution (RAC): This is a fully refundable lump sum payment calculated based on the Daily Accommodation Contribution (DAC).

- Daily Accommodation Contribution (DAC): This option involves periodic payments spread out over time.

- Combination Payment: Residents can choose a combination of RAC and DAC to suit their financial situation.

Residents classified as accommodation payment have similar payment options, but with different terminology:

- Refundable Accommodation Deposit (RAD): This is the equivalent of RAC for accommodation payment residents.

- Daily Accommodation Payment (DAP): This functions the same way as DAC for low means residents.

- Combination Payment: Similar to low means residents, they can choose a combined approach using RAD and DAP.

‘Low means’ resident

In Australia’s aged care system, the government assesses a resident’s financial resources to determine their contribution towards accommodation costs. Residents with limited assets and income are classified as low means. This classification offers significant financial advantages.

Unlike residents with higher means, low means residents are not required to pay the full advertised price for their aged care accommodation. Instead, they contribute a capped amount called a daily accommodation contribution (DAC). This DAC is calculated based on two factors:

- The resident’s income and assets: This is assessed by the government to determine their financial ability to contribute.

- The maximum government subsidy (accommodation supplement): This subsidy helps offset the cost of accommodation for eligible residents.

The lower of these two figures is used to determine the resident’s daily contribution. This ensures low means residents pay an affordable amount for their aged care stay.

Residents’ contributions towards accommodation can vary over time. This is because Centrelink or DVA recalculates their means-tested amount monthly. If this amount reaches zero, the resident won’t have to pay an accommodation contribution.

The amount of government support the facility receives (accommodation supplement) depends on its age, recent refurbishments, and whether it meets resident support ratios. Residents can enquire directly with the facility about the applicable supplement.

Residents with limited financial resources, known as “low means” residents, have flexibility in how they pay for their accommodation. They can choose a Daily Accommodation Contribution (DAC), a Refundable Accommodation Deposit (RAD), or even a combination of both. The MPIR (Maximum Permissible Interest Rate) comes into play when converting a DAC into an equivalent RAD amount.

(DAC x 365) / MPIR = equivalent RAC

Since Centrelink/DVA regularly reassesses a resident’s financial situation, the DAC amount (and consequently the equivalent RAD) may fluctuate. This means the aged care facility might need to either refund a portion of the RAD if the resident’s means improve, or the resident may need to start contributing a daily amount (DAC) if their financial situation changes.

The relationship between the MPIR and the RAC is inversely proportional. This means that when the MPIR goes up, the equivalent RAC calculated on the maximum accommodation supplement goes down as follows.

| DATE | MPIR | MAXIMUM ACCOMMODATION SUPPLEMENT | EQUIVALENT RAC |

|---|---|---|---|

| 1 April 2022 | 4.07% | $68.14 | $611,084 |

| 1 July 2022 | 5.00% | $497,422 | |

| 1 October 2022 | 6.31% | 394,154 | |

| 1 January 2023 | 7.06% | $352,282 | |

| 1 April 2023 | 7.46% | $333,393 | |

| 1 July 2023 | 7.90% | $314,824 | |

| 1 October 2023 | 8.15% | $305,167 | |

| 1 January 2024 | 8.38% | $296,791 | |

| 1 April 2024 | 8.34% | $298,215 |

The MPIR is locked in on the day a low-means resident enters an aged care facility. It won’t change as long as they stay there. However, if they move to a different facility, the new MPIR rate will apply.

Example

Sarah entered residential aged care on 1 April 2022. Upon assessment, she was classified as a ‘low means’ resident. Sarah currently has investments totaling $150,000 in term deposits, along with $5,000 in personal belongings. Her daily means tested care fee is $45.91. The aged care facility itself receives the maximum accommodation supplement

If Sarah pays $100,000 as a RAC, how much will she pay as a DAC?

$100,000 x 4.07% / 365 = $11.15 per day

$45.91 – $11.15 = $34.76 per day

Sarah relocated to a new aged care facility on 1 April 2024. She was assessed as a low means resident. Consequently, her daily means tested care fee remains at $45.91. Additionally, the new facility receives the maximum accommodation supplement.”

If Sarah pays $100,000 as a RAC, how much will she pay as a DAC?

$100,000 x 8.34% / 365 = $22.85 per day

$45.91 – $22.85 = $23.06 per day

If Sarah moves to a different aged care facility, her Daily Accommodation Contribution (DAC) will be recalculated based on the current MPIR. Since the MPIR has gone up, the new DAC for her $100,000 Refundable Accommodation Deposit (RAC) will also be higher. However, this change in facility could still benefit Mary. By moving, she might be able to reduce her daily fee from $34.76 to $23.06.

‘Accommodation payment’ resident

Residents are classified as either “accommodation payment” or “supported resident” based on a means test. “Accommodation payment” residents, with assets exceeding a specific limit, contribute to the cost of their stay.

Aged care facilities advertise their maximum accommodation prices, currently capped at $550,000 without special permission. Residents can choose to pay this amount as a lump sum (Refundable Accommodation Deposit or RAD) or opt for a daily fee (Daily Accommodation Payment or DAP), or even a combination of both.

The MPIR (Maximum Permissible Interest Rate) comes into play for residents choosing the RAD option. This government-set interest rate is used to convert the lump sum RAD into an equivalent daily fee (DAP).

RAD x MPIR / 365 = equivalent DAP

As the MPIR has increased, the equivalent DAP calculated on the maximum advertised accommodation price has increased as follows:

| DATE | MPIR | MAXIMUM ADVERTISED ACCOMMODATION PRICE | EQUIVALENT DAP |

|---|---|---|---|

| 1 April 2022 | 4.07% | $550,000 | $61.33 |

| 1 July 2022 | 5.00% | $75.34 | |

| 1 October 2022 | 6.31% | $95.08 | |

| 1 January 2023 | 7.06% | $106.38 | |

| 1 April 2023 | 7.46% | $112.41 | |

| 1 July 2023 | 7.90% | $119.04 | |

| 1 October 2023 | 8.15% | $122.81 | |

| 1 January 2024 | 8.38% | $126.27 | |

| 1 April 2024 | 8.34% | $125.67 |

The MPIR is locked in upon entering the aged care facility and applies to the chosen room. It remains unchanged unless you decide to move to a different room within the same facility or relocate entirely. In such cases, the current MPIR will be used to calculate your new Daily Accommodation Payment (DAP) and Refundable Accommodation Deposit (RAD) based on the advertised price of the new room.

Importantly, if you’re involuntarily moved within the facility, the provider cannot charge you more for the new room. The current MPIR will be used to determine the equivalent RAD and DAP for the new accommodation’s advertised price.

For residents opting for a combined RAD and DAP payment structure, the DAP is deducted from the RAD. However, this deduction increases the outstanding RAD amount, which in turn raises the daily DAP.

Example

Sam, who entered aged care on April 1st, 2022, classified as an ‘accommodation payment’ resident. John has $350,000 invested and $5,000 in personal belongings. The facility offers a room for $500,000.

Suppose Sam chooses to pay a $300,000 Refundable Accommodation Deposit (RAD) and a $200,000 Daily Accommodation Payment (DAP). He also decides to deduct the DAP amount from his RAD balance monthly. In this scenario, let’s explore how much would be deducted from his RAD over the first six months.

| MONTH | OUTSTANDING RAD | DAP |

|---|---|---|

| 1 | $200,000 | $200,000 x 4.07% / 365 = $22.30 |

| 2 | $200,000 + ($22.30 X 30) = 200,669 | $200,669 x 4.07% / 365 = $22.38 |

| 3 | $200,669 + ($22.38 x 31) = $201,363 | $201,363 x 4.07% / 365 = $22.45 |

| 4 | $201,363 + ($22.45 x 30) = $202,037 | $202,037 x 4.07% / 365 = $22.53 |

| 5 | $202,037 + ($22.53 x 31) = $202,735 | $202,735 x 4.07% / 365 = $22.61 |

| 6 | $202,735 + ($22.61 x 31) = $203,436 | $203,436 x 4.07% / 365 = $22.68 |

Sam, who is classified as an ‘accommodation payment’ resident, enters a new aged care facility on 1 April 2024. The facility offers a room for $500,000. Let’s say John chooses a combined payment option, contributing $300,000 as a Refundable Accommodation Deposit (RAD) and $200,000 as a Daily Accommodation Payment (DAP).

If Sam decides to deduct the DAP amount from his RAD balance monthly, we can explore how much would be deducted in the first six months.

| MONTH | OUTSTANDING RAD | DAP |

|---|---|---|

| 1 | $200,000 | $200,000 x 8.34% / 365 = $45.70 |

| 2 | $200,000 + ($45.70 x 30) = $201,371 | $201,371 x 8.34% / 365 = $46.01 |

| 3 | $201,371 + ($46.01 x 31) = $202,797 | $202,797 x 8.34% / 365 = $46.34 |

| 4 | $202,797 + ($46.34 x 30) = $204,187 | $204,187 x 8.34% / 365 = $46.66 |

| 5 | $204,187 + ($46.66 x 31) = $205,633 | $205,633 x 8.34% / 365 = $46.99 |

| 6 | $205,633 + ($46.99 x 31) = $207,090 | $207,090 x 8.34% / 365 = $47.32 |

If John relocates to a different aged care facility, the MPIR applied to his Refundable Accommodation Deposit (RAD) will adjust to the current rate. Since the MPIR has gone up, the Daily Accommodation Payment (DAP) calculated on his remaining RAD balance will also increase. In essence, moving facilities leads to a higher DAP for John.

Navigating the financial aspects of aged care can be complex, especially with factors like the MPIR influencing costs. We are here to help you understand your options and make informed decisions. Our team can provide personalised advice tailored to your circumstances, be it maximising government assistance or strategically managing accommodation payments. Contact us today on 1300 550 940 or visit our website for more information. Remember, informed decisions lead to better financial security throughout your aged care journey.