Do I need to sell my home for aged care?

Table of Contents

ToggleIf you or your loved one are considering aged care, you might be wondering, “Do I need to sell my home for aged care?” Entering aged care can be an emotionally and financially challenging decision. A common misconception is that you must sell your home in order to cover the cost of admission into a facility, however, this isn’t always true – it all comes down to individual circumstances. Each individual’s situation is unique, so it pays off to speak with an expert in aged care financial planning before making any decisions that could affect admission fees and pension considerations.

Our clients often start out with the misconception that they are forced to sell their home by Centrelink, or by an aged care provider, usually from some second-hand information from a friend. They ask questions when we first speak such as:

- Do I need to sell my home to pay for care?

- Do nursing homes make people sell their homes?

This of course causes some resentment towards the aged care system, perhaps the government legislators and even the aged care providers, as they feel it is unfair to take someone’s home.

They’d be right of course, but fortunately, this is a fallacy. The home can be kept as long as aged care fees can be paid, however, keeping the home is sometimes not the best strategy depending on your goals. Centrelink and aged care providers do not force residents to sell their homes before entering care.

To ensure you make the right choice for yourself or those who depend on your pension income, consulting with a qualified aged care financial planner should be a top priority when making such important decisions. With qualified guidance from a caring specialist, you’ll have all the information needed for peace of mind as you or a loved family member set out into this new phase of life.

The aged care fee structure

When considering an aged care home, it’s important to know the associated costs. From a means assessment of your income and assets, you can determine how much needs to be paid for various types of fees. To further complicate things there are two separate fee structures:

- Full fee-paying residents

- Low-means residents (a.ka. supported, concessional)

Australia’s Department of Health and Aged Care governs residential aged care with national rules contained in the Aged Care Act 1997. In order to determine the affordability for these services, a means-tested assessment is conducted by Services Australia or Veterans Affairs to calculate a means-test amount (MTA). This calculation assesses both an individual’s assets and income prior to determining how much they can daily contribute towards their care needs.

Low-means residents

Aged care residents who have limited financial capacity are assessed under the current rates with a Means-test Amount lower than $65.49 (20 March 2023 rate) upon admission to residential care. This MTA is determined by assessing both income and assessable assets, which if it is equal to or higher than the capped value for the home (currently $197,735.20 and indexed twice a year) disqualifies that person as low means. In cases where couples apply, individual halves will be split equally–and must be below this capped amount in order to qualify.

If the market value of a client’s home exceeds the capped limit and there are no qualifying protected persons residing in it, unfortunately, they will be ineligible for low-means residency.

Low means residents will pay the same basic daily fee as full fee-paying residents, however, they will not pay a means-tested care fee, and will pay an accommodation fee as a DAC (Daily Accommodation Contribution) or a RAC (Refundable Accommodation Contribution).

Unlike a full-fee-paying resident, the amount of contribution will vary with quarterly reviews of the assets and income of the client, and if significant changes occur the fees may actually end up more expensive than a full-fee-paying resident. A resident never loses the low means assessment at the date of entry, which can be to their detriment at times, in event of inheritance or windfall for example. Fortunately, some providers limit the RAC to the RAD amount which is perhaps a question that should be asked when choosing a provider.

The amount of government support will vary from provider to provider and will depend on the percentage of low-means residents they currently have (under or over 40%), and whether it is considered a new or refurbished facility. A new/refurbished facility with more than 40% receives the most government accommodation supplement, which unfortunately means that there is little benefit for them to take on more than 40% low-means residents. What this means for you is that some providers will not have low-means availability while they will have availability for full -fee paying residents, so in some situations, there is less choice of rooms for low-means residents.

If a client is assessed as low-means, they cannot be asked to pay the published price for a room. Instead, the government sets the room price as a daily fee depending on the classification of the aged care provider.

Case Study: Jack and Jill

- Home worth $1,000,000

- Contents $5,000 (Centrelink value)

- Investments $200,000

Jack is going into aged care with Jill remaining in the family home. Jill is a protected person as she is Jack’s spouse. This means the house is assessed as an asset so Jack is assessed to have assessable assets of $102,500 and an MTA well under $65.49. This is below the threshold, and he qualifies as a low-means resident.

Sometime later Jill is entering aged care to join Jack. No protected person will remain in the home so it is assessed up to the capped value ($197, 735.20 as of 1 January 2024), plus other assets, and divided by two. This results in a MTA above the threshold so Jack is a full fee-paying resident, however, Jill does not lose her low-means assessment although the daily contribution may increase if the home is sold.

Full fee-paying residents

Navigating the complexities of aged care fee structures can be daunting. There are multiple fees within and each is calculated differently according to individual circumstances – meaning it may not always be easy to know when selling your house would best benefit you financially.

Fortunately, a qualified professional in this field should have expertise that allows them to explain these systems in ways understandable for all people – so make sure you reach out if needed. Taking advantage of their knowledge could help determine whether or not downsizing will improve financial stability long-term.

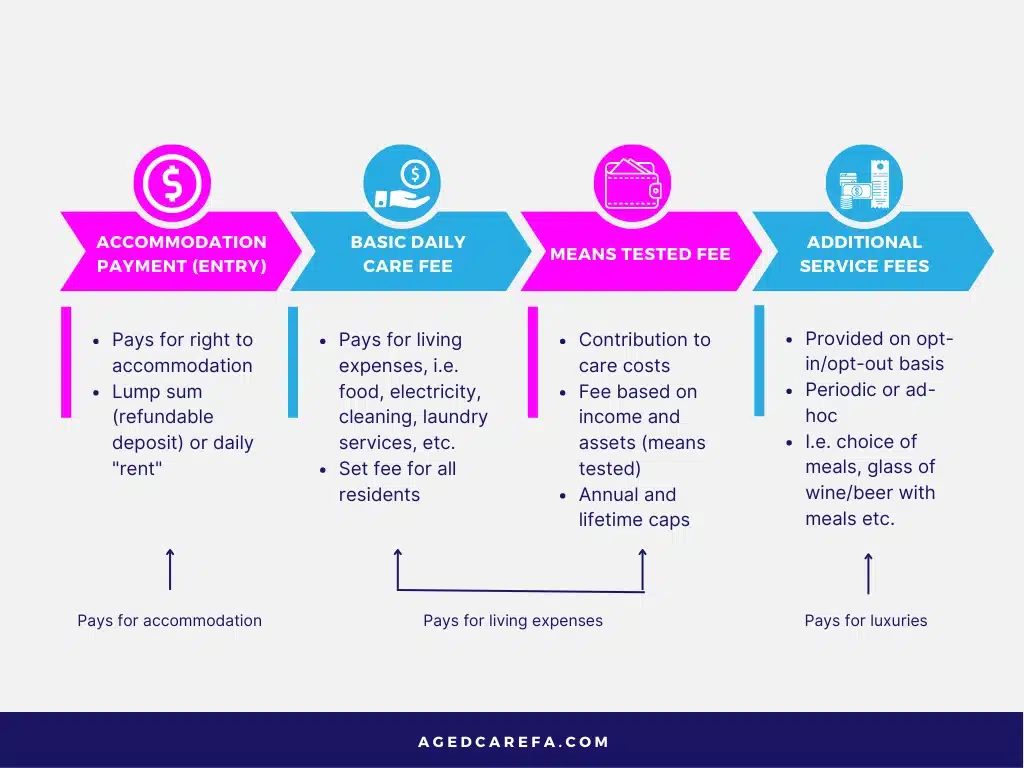

Full fee-paying residents may be required to pay the following fees:

- Accommodation Fee

- Basic daily fee

- Means-tested care fee

- Additional services fee

What is the accommodation fee?

As you transition into aged care, we understand that the payment arrangements can seem daunting or complex. That’s why our team is here to help guide and support you through this process if needed – so do not hesitate in asking questions! Your accommodation cost will be broken down for both your ease of understanding and financial convenience with two methods of payment: a lump sum Refundable Accommodation Deposit (RAD), similar to buying a room; or paying daily rent known as Daily Accommodation Payment (DAP).

Just like paying a home, the accommodation fee (RAD) is refunded in full upon exiting aged care. Also like renting a home, rent paid (DAP) is not returned when exiting residential aged care.

Every aged care home provides different pricing structures based on factors like location and room size, so the amount you pay for accommodation is up to your own choices. Depending on where you decide to move in, and if government help is available through a means assessment result -the ultimate cost could vary greatly from one option to another.

The provider is willing to negotiate and accept a lower accommodation payment that could work in the resident’s favour. If DAPs are being paid, reducing the room cost may reduce costs overall; whereas with lump sum payments it can be beneficial for more assets to be exempt from assessment and not exceed Centrelink/DVA thresholds – thereby potentially increasing pension entitlements.

If paying the DAP instead of the RAD, the amount that is to be paid is calculated by multiplying the RAD by a percentage the government sets known as a Maximum Permissble Interest Rate (MPIR) (currently 7.61% as of September 2025).

Selling, keeping empty, or renting the home will not impact the accommodation fee, however selling home may improve affordability.

What is the basic daily fee?

Australian aged care residents can feel secure knowing they will always receive the same quality of service – regardless of their assets or means. This is because a basic daily fee covers day-to-day services such as meals, cleaning, and laundry for each resident. As of 20 September 2025, that rate stands at $65.55 per day. This is calculated based on 85% of the full-rate age pension for single or illness-separated couples allowing seniors peace of mind when it comes to budgeting for aged care living expenses.

Selling, keeping empty, or renting the home will not impact the basic daily fee.

What is the means-tested fee?

The means-tested care fee is an important consideration when looking into aged and health care services. It can greatly affect the cost of your personal and clinical needs – but not everyone has to pay it, as it’s determined through a thorough resource assessment by Services Australia. Depending on your situation, you may have a daily fee anywhere from $0 up to $358.41 – plus there are daily, annual, and lifetime caps in place that’ll help protect against excessive fees accruing over time.

The current means-tested care fee caps are:

- The amount of MTF payable in each anniversary year is limited to the annual cap currently $35,238.11.

- The MTF is also subject to a lifetime cap of $84,571.66.

It’s important to understand that the means-tested care fee could be affected by decisions you make in regard to the former home. Before making any financial moves, we strongly advise seeking professional advice so that you can ensure your fees are best tailored to your individual circumstances and pension assessment.

Remember, if a sale of the home does occur this may impact how much money must go toward paying for care services as a means-tested care fee and may even reduce the age pension entitlement– but with the help of an expert aged care financial adviser there’s every chance we can show the impact this decision will have on the fees during aged care.

Selling, keeping empty, or renting the home WILL impact the means-tested care fee.

What is the additional services fee?

Many aged care providers offer additional services that aren’t subsidised by the government – ensuring your loved one receives a higher standard of care. If you opt for these extra services, it’s important to factor them into your cash flow and budgeting as they may add up over time to a substantial amount.

Selling, keeping empty, or renting the home will not impact the additional services fee.

Do I need to sell my home for aged care?

With the right guidance, you can ensure that your decision around what to do with the former home and the move into aged care is tailored specifically to meet your individual needs and financial goals. At Aged Care Financial Advisers we believe in empowering our clients with the best advice so they feel confident when making any big decisions such as selling their home before entering an aged care facility. We understand how important this process is for preserving pension entitlements and avoiding unnecessary fees or charges – which could end up costing you significantly if not managed properly. Contact us now at 1300 550 940 to have a conversation about your situation today.

Here are some things to consider before selling or renting the former home:

- If the home is retained the means-tested care fee uses the capped value of the home. As most homes are worth significantly more than this, selling the home often increases the means-tested care fee. But this is only one piece of the puzzle!

- The home is not assessed as an asset for DVA/Age pensions for 2 years from the date of entry into aged care. If the home is sold, these funds are assessable much sooner.

- If the home is rented it is not counted as an asset for DVA/age pensions, but the income is assessed. This doesn’t mean it is not a good option, age pension might reduce a little but rental income may increase overall income.

- If the home is sold, what is the best course of action for the proceeds?

- Retaining the home and leaving it empty causes potential issues for home insurance, vandalism, squatters, etc

- Are there sufficient assets to fund aged care fees without selling the home?

Aged Care Financial Advisers help to answer all these questions. We get to understand your unique situation and then look at what the means assessment will look like, and calculate the aged care fees. Then we investigate a number of scenarios (generally 3-5) such as what to do with the home and its impact on aged care fees and aged pensions. If selling the home we investigate what the best course of action might be for the proceeds. The aim of our service is to first make sure the aged care is affordable and show this over either 5 years or 10 years of cashflow projections to identify feasible strategies. Sometimes keeping the home won’t work.

Then we look at the impact these strategies have on both the net assets of the resident and the potential estate assets (after home sale expenses, and potential tax on superannuation funds). This way our clients have a full picture and understanding of the consequences, benefits, and disadvantages of each strategy. Book your Free Introductory Call and learn how we can help.