Three Phases of Retirement

Planning for your retirement can be exciting. To maximise your independence and minimise frailty risk, consider your needs across the phases of retirement.

Retirement planning assumed a constant indexed income which did not allow for higher care needs in later life.

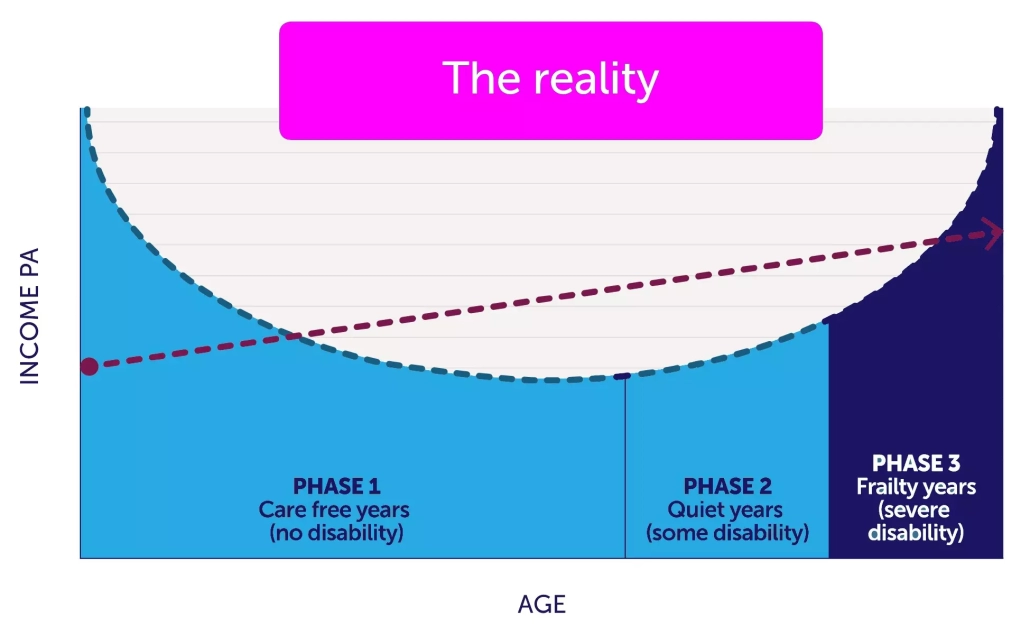

The spending pattern in retirement will vary based on your ability and it looks more like a smile than a straight line.

The Three Phases of Retirement

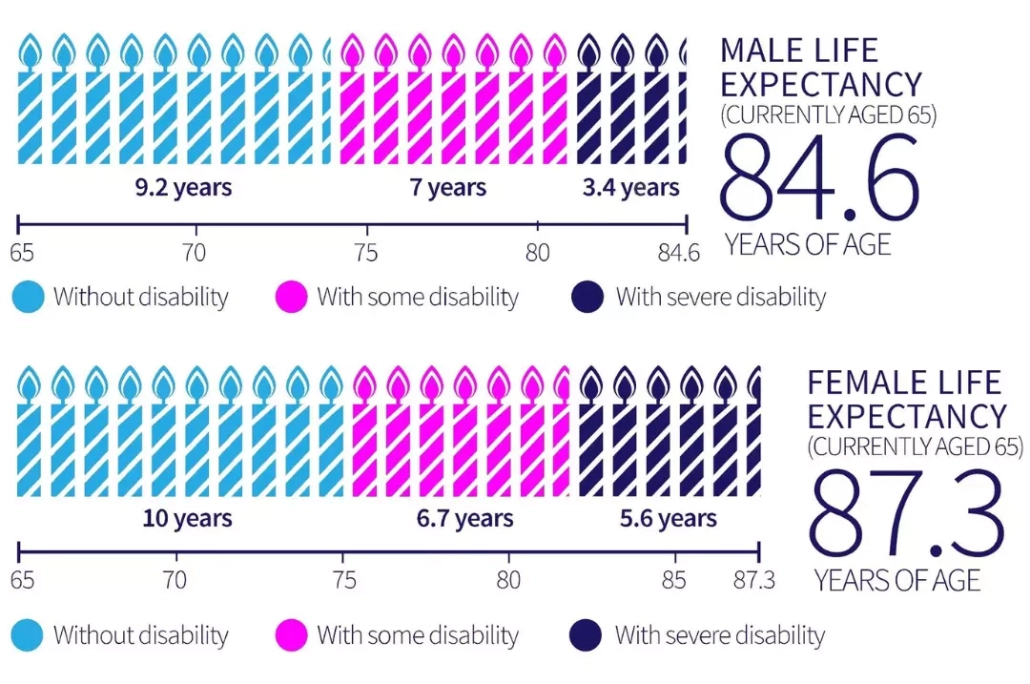

Source: Australian Institute of Health and Welfare – selected health expectations by age 65, by sex, 2015.

Frailty Risk

Access to government subsidies helps make care affordable. But adequate savings to fund the increasing cost of care opens up choices and allows greater independence and control.

Things to Consider

- 1. How you expect to fund aged care costs?

- 2. What role your home can play?

- 3. The impact of relying on family and friends for support.

- 4. Are you willing to ignore frailty years?

Schedule Your Appointment

Interested in finding out more about Aged Care Financial Advisers? Get in touch if you’d like to find more about our aged care services or need help working out your next steps.

Aged Care Financial Advisers ABN 91 600 073 630 is an Authorised Representative of Lifespan Financial Planning Ltd AFSL 229892

LOCATION: 300 Ruthven Street Toowoomba QLD 4350

CALL US: 1300 550 940

BUSINESS HOURS

Mon – Fri…….. 8am – 6pm

Sat – Sun…….. Closed

Disclaimer: The purpose of this website is to provide general information only. It is not intended to be financial advice, however, any advice provided is general in nature and does not consider your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please speak to your Lifespan financial adviser before making any financial decisions.