The Importance of Financial Planning for Aged Care

The Emerging Trend

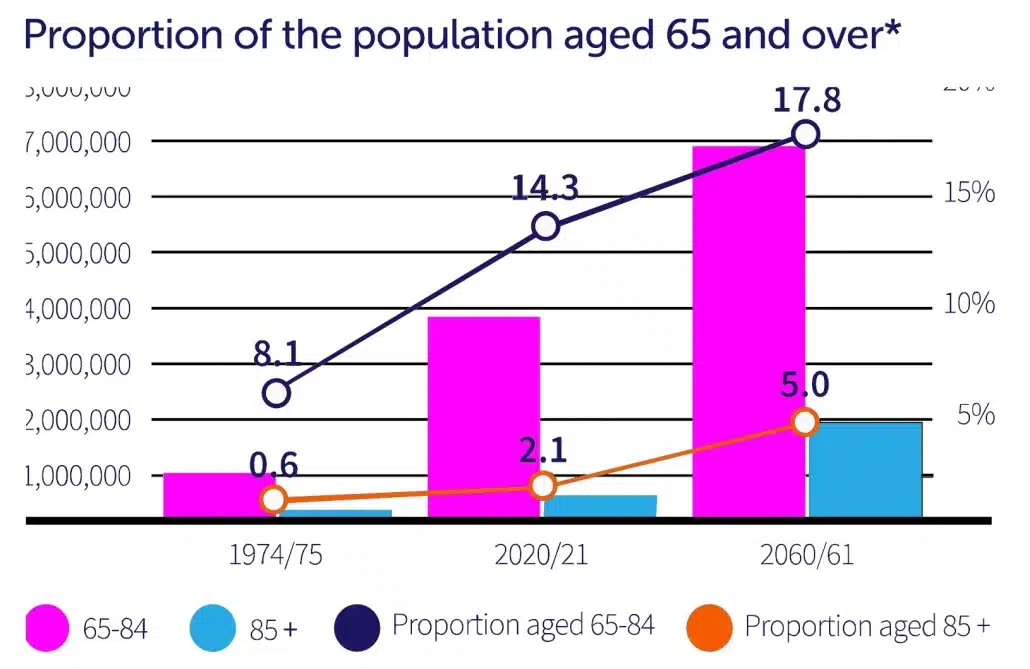

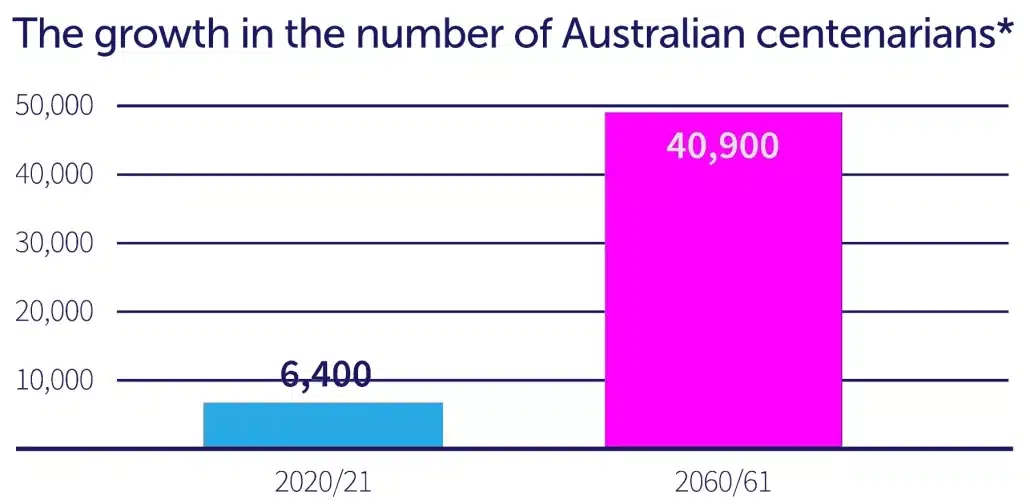

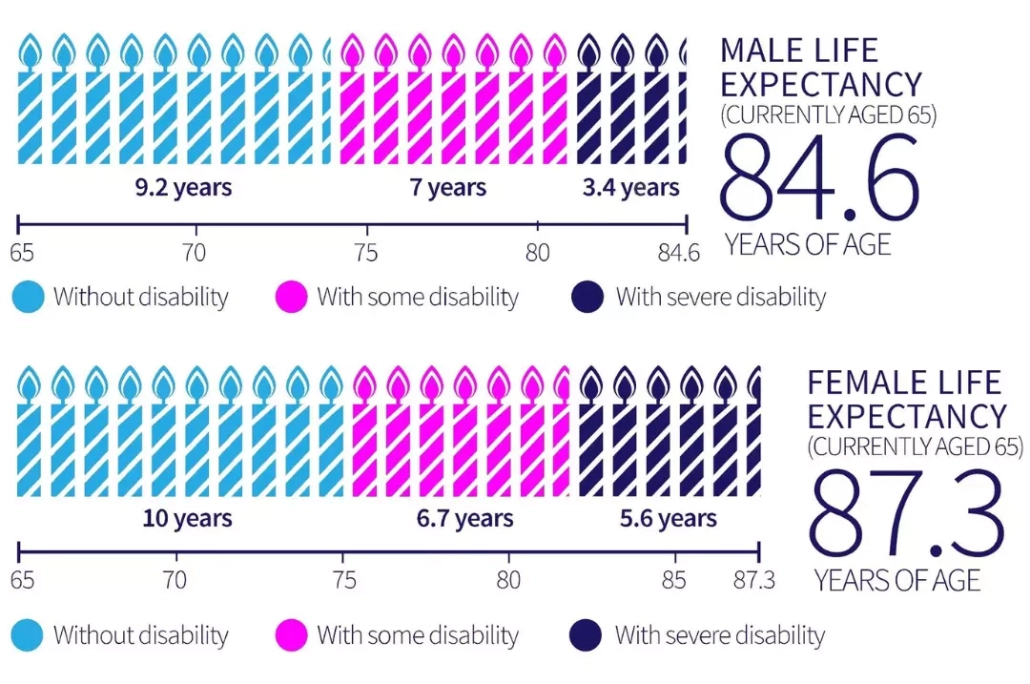

Our chances of living longer are increasing as life expectancies continue to increase. This is dramatically increasing the number of older Australians and will transform Australia economically and socially over the next 40 years. Have you prepared for your aged care needs?

*Source: The Commonwealth of Australia. 2021 Intergenerational Report. Australia over the next 40 years.

Our Support

- Help you create a clear plan for aged care.

- Family discussions to minimise disputes.

- Evaluate the options and strategies for your accommodation payment.

- Help you identify what’s important to achieve your goals and preferences.

- Review your financial situation and help you evaluate what you can afford.

- Develop strategies to optimise your financial position.

- Review your estate plan to avoid unintended consequences.

The Growing Need

Approximately one-quarter of your retirement is expected to be “care years” where help may be needed with daily living activities.

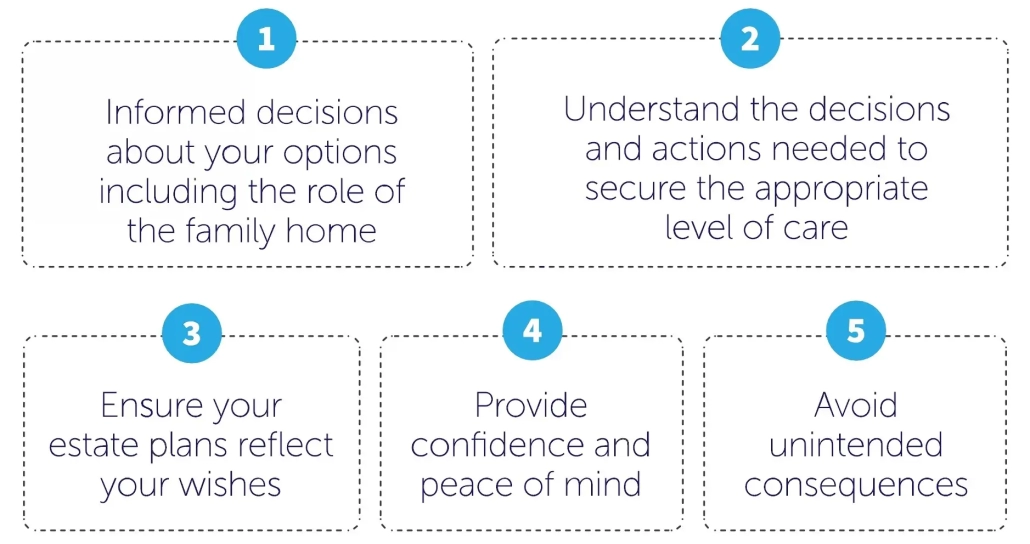

Value of Aged Care Advice

Early planning and good advice can take the stress out of aged care decisions for you and your family.

Did You Know?

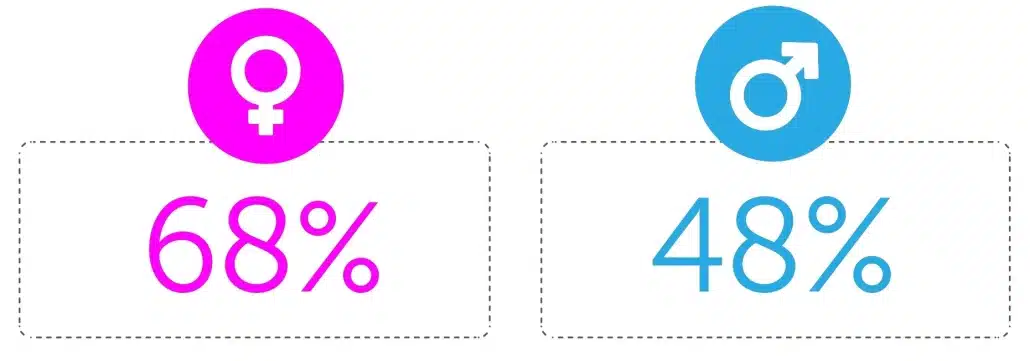

At age 65, a person’s chance of needing aged care during their remaining lifetime is…

*Source: Australian Government Productivity Commission Inquiry Report. Caring for older Australians. 20 June 2011

Schedule Your Appointment

Interested in finding out more about Aged Care Financial Advisers? Get in touch if you’d like to find more about our aged care services or need help working out your next steps.

How Nursing Home Financial Advice Can Help You

Financial Advice - an important piece of the puzzle

One of the most confusing aspects of the aged care process is making financial decisions about where to live. When you combine this with the whirlwind of emotions, you have a perfect storm that can lead to impulsive actions that could compromise your long-term financial security.

Financial advice isn’t just about superannuation and investments. Financial advice is about providing clarity and customised options in the face of information and media ‘noise’. It provides residents and their families with financial options to help see that care is affordable and that financial goals can still be achieved.

Getting a nursing home financial advice will help you gain a better understanding of your financial situation and how it will affect your aged care costs. Having this financial clarity before you need aged care can assist you in making a well-informed option that meets your financial, lifestyle, and care needs.

Are you finding the aged care process confusing and intimidating?

We’ll walk you through every step of the process, so you can relax knowing that your loved one is in good hands.

Benefits for residents and families

Financial advice from an accredited aged care adviser can help your potential residents and their families to:

Access the right information and understand how it applies to them

Fully understand their financial choices and obligation to pay fees

Free up cashflow to afford the extras that add to lifestyle

Spend more of their time dealing with the practical aspects of moving into care by letting a professional guide them through the financial aspects.

Benefits for Providers

Directing clients to an accredited aged care adviser can also provide benefits to you as the care provider through:

- Outsourcing the explanation of rules and choices to an accredited adviser to save you time and ensure you do not overstep Corporations Act rules on giving advice. You can avoid saying the wrong thing or giving inappropriate or incorrect information.

- Accurate and timely completion of the Centrelink/DVA assessment forms and an estimate of means-tested fee which may minimise your administration complexity.

- Ability to work with the adviser to determine if the resident might be low-means so you can offer the right room to the right resident.

- Accredited advisers can help clients to manage and maximise cashflow, which may help the residents to afford additional services.

Five Mistakes Aged Care Financial Advisers Help You Avoid

Many people think they have to sell their home to fund aged care. But advice from Aged Care Financial Advisers can show them the choices and full implications of their decisions.

Many people see RADs as lost money. Aged Care Financial Advisers can explain refunds and government guarantees as well as show clients how to make the most of Centrelink exemptions for RADs.

The rules and terms are complex and timeframes to make decisions are often limited. Aged Care Financial Advisers can help take out the stress and allow more effective decision-making in the timeframe available.

Cashflow is the big story when planning aged care costs. Aged Care Financial Advisers start with creating enough cashflow so obligations can be met and extras can be funded to improve their lifestyle.

Who doesn’t want to pay less for services? But Aged Care Financial Advisers focusses first on helping clients to afford and access the right care, and then looking at options to how to manage the affordability.

Schedule Your Appointment

Interested in finding out more about Aged Care Financial Advisers? Get in touch if you’d like to find more about our aged care services or need help working out your next steps.

We are an Accredited Aged Care Professional®. This means we have the knowledge and skills to be able to provide specialist aged care advice.

We don’t want to make our advice fees as complex as aged care. Instead, we offer simple transparent pricing that makes sense and provides value.

We will deliver on what we promise. If you are not satisfied with our service, we will refund your fees.

We understand the time constraints of aged care well. We deliver formal written advice and take the time to discuss with you.

Aged Care Financial Advisers ABN 91 600 073 630 is an Authorised Representative of Lifespan Financial Planning Ltd AFSL 229892

LOCATION: 300 Ruthven Street Toowoomba QLD 4350

CALL US: 1300 550 940

BUSINESS HOURS

Mon – Fri…….. 8am – 6pm

Sat – Sun…….. Closed

Disclaimer: The purpose of this website is to provide general information only. It is not intended to be financial advice, however, any advice provided is general in nature and does not consider your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. Please speak to your Lifespan financial adviser before making any financial decisions.